.webp?width=700&height=350&name=intent-attractiveness-home-goods@2x%20(1).webp)

Sixty-six percent of home goods shoppers include ecommerce in their buying journey — whether it’s simply to start their research and pre-shop before visiting a store, find showroom pieces online, or take an entirely digital path. But while shoppers have evolved, most ecommerce search engines haven’t. They still rely on rigid keyword matching to interpret nuanced, emotional, or style-driven keywords – leaving many high-intent shoppers unseen.

According to the most recent State of Ecommerce findings, 61% of shoppers say retail search needs an upgrade. That gap represents a huge opportunity. In home goods, searchers make up just 14.2% of site visitors yet are 3x more likely to add to cart and convert than browsers. These shoppers know what they want – and expect sites to know it too.

The challenge for home goods retailers is to go beyond technical relevance and build search engines that understand and anticipate shopper intent, surfacing products they’ll love at the right moment and in the right context. Below, we unpack what that takes – and what it means for ecommerce merchandisers and product leaders optimizing for both customer- and business-centricity.

How Does Home Goods Compare to Other Categories?

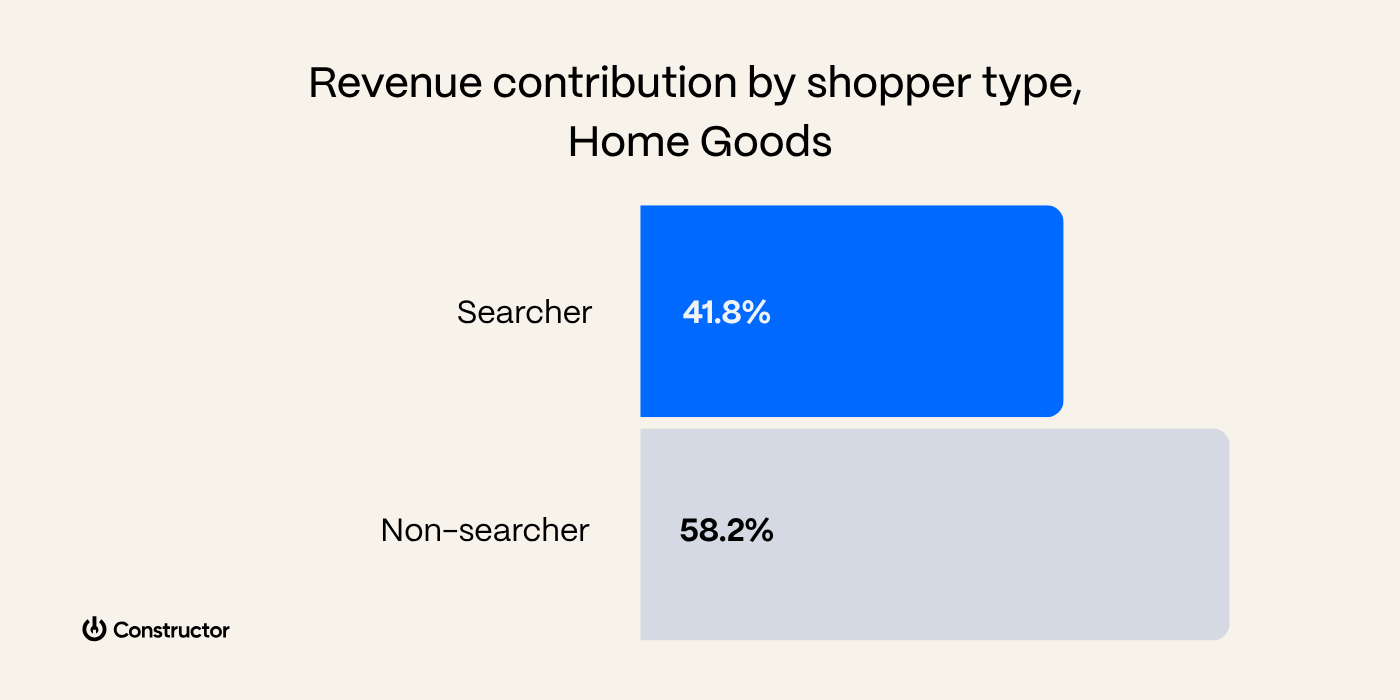

Across ecommerce industries, 24% of visitors who use site search drive 44% of site revenue.

This number is even more dramatic when segmented to home goods. While only half as many visitors search on home goods sites as the cross-industry average (14.2% vs 24%), these high-intent shoppers contribute nearly the same portion of revenue (41.8% vs 44%).

In other words, home goods searchers convert.

Percent of Searchers vs Non-searchers on Home Goods websites

Searchers: 14.2%, Non-searchers: 85.8%

Percent of Searchers vs Non-searchers that add-to-cart on Home Goods websites

Searchers: 30.2%, Non-searchers: 10.9%

Percent of Searchers vs Non-searchers that convert to sale on Home Goods websites

Searchers: 11.3%, Non-searchers: 3.6%

Percent of revenue contribution from Searchers vs Non-searchers on Home Goods websites

Searchers: 41.8%, Non-searchers: 58.2%

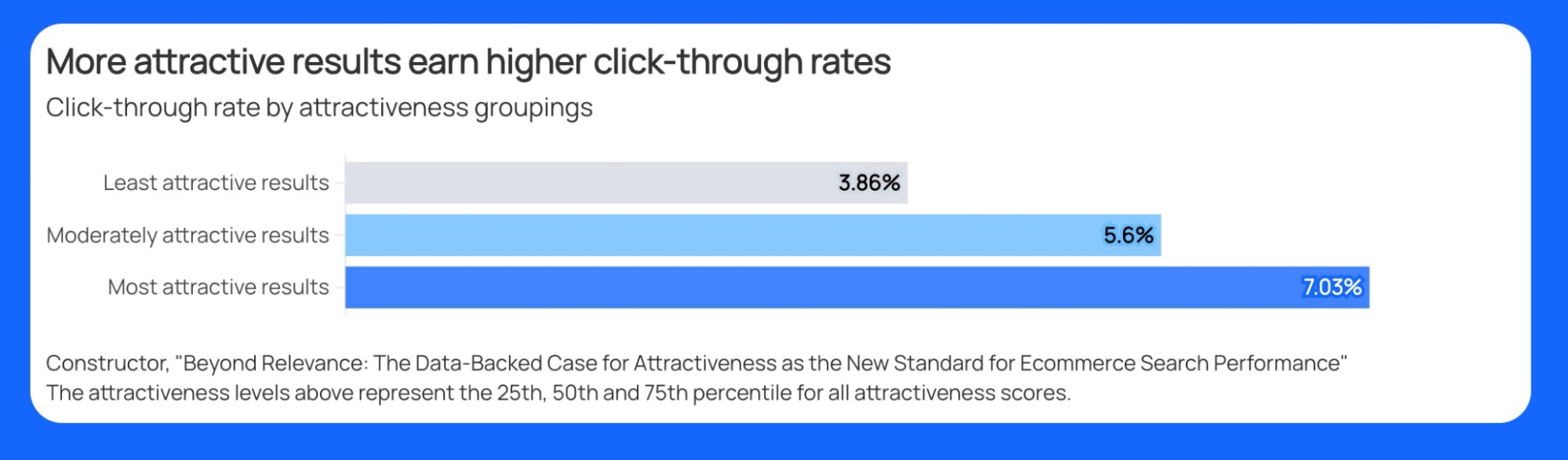

Search-driven revenue hinges on the quality of search results. Our data shows that searchers are twice as likely to click through to products when they’re ranked by attractiveness versus simple keyword relevance.

(What is attractiveness? We have an in-depth explainer on what makes search results attractive and what goes into an attractiveness algorithm, which we will expand on later in this article. For now, a simple definition to start with is that attractiveness measures the probability that serving a certain search result will turn into a desired action, such as an add-to-cart or conversion.)

What are the Characteristics of Home Goods Queries That Convert?

Home goods shopping is often driven by project-based discovery rather than impulse buying. Purchases are part of a planned home project or room makeover, or serve a practical and functional purpose. The right look, right size, and right specs matter. Customers have to literally live with their purchase decisions.

With this in mind, our Data Science team thought it’d be interesting to analyze query length and conversion potential, and benchmark this data against other industries.

For starters, we found that approximately 87% of home goods queries are short-tail queries, also known as head terms, which are composed of two to three words. This is similar to other industries in ecommerce.

In the home goods sector, these head terms could manifest as customers mentioning broad categories as a starting point, providing clues as to the exact room they’re looking to furnish, such as “kitchen cloth” or “bedroom pillows.”

The remaining 13% are long-tail, which are shown to convert more than short-tail because they tend to be “closer to purchase” by virtue of their specificity.

Nevertheless, not all long queries convert at the same rate. (They are also the most at risk for a search engine to “get wrong” if it’s designed to rank results by keyword relevance.)

Our data shows that the conversion rate for long narrow queries is higher than for short queries. It’s even higher than the industry average (17% vs 12%, respectively).

Long narrow searches can include keywords that match the buying criteria in shoppers’ minds and often include multiple product attribute keywords, such as style, size, material, or themes (like “6’x9’ rug for kids room” or “mid century curved sectional couch ivory boucle”).

Long wide requests, on the other hand, have lower conversions than the short ones (-7%). Even though they’re long, they show more exploratory intent rather than decisive intent. Examples of long wide requests include “modern or rustic furniture for small apartments and outdoor patios” or even “boho or coastal décor for bedroom and bathroom with gold accents.”

To discover more about the truth behind head and long searches industry-wide, check out our detailed analysis from more than 70M user search requests, and what these results mean for ecommerce teams.

Common Search Challenges for Home Goods Teams

Here are common challenges ecommerce merchandisers and digital product managers are up against when trying to use a keyword-based search solution to provide 1:1 shopping experiences:

Keyword matching can go awry

Search engines that rank products by keyword matching generally struggle with all queries, but particularly long queries.

On the back end, the engine needs to parse out multiple terms and match keywords to product data. They’ll often exclude results if the search query contains synonyms or misspellings relative to potential product matches. Alternatively, they may pull matches for every individual keyword, cluttering the results set.

For example, a search for “bamboo double drawer night stand with legs” could miss products tagged as “bedside table” or even “nightstand” if the keywords in product data don’t exactly match the user’s input. Even minor typos can mean missed matches.

Similarly, the engine may pull matching results for anything matching “bamboo,” “double,” “drawer,” “night,” “stand,” or “legs.”

Synonyms aren’t a replacement for semantic meaning

Keyword-based search may match to synonyms if they exist in the vocabulary or have been added manually. But at scale, many search results fall through the cracks.

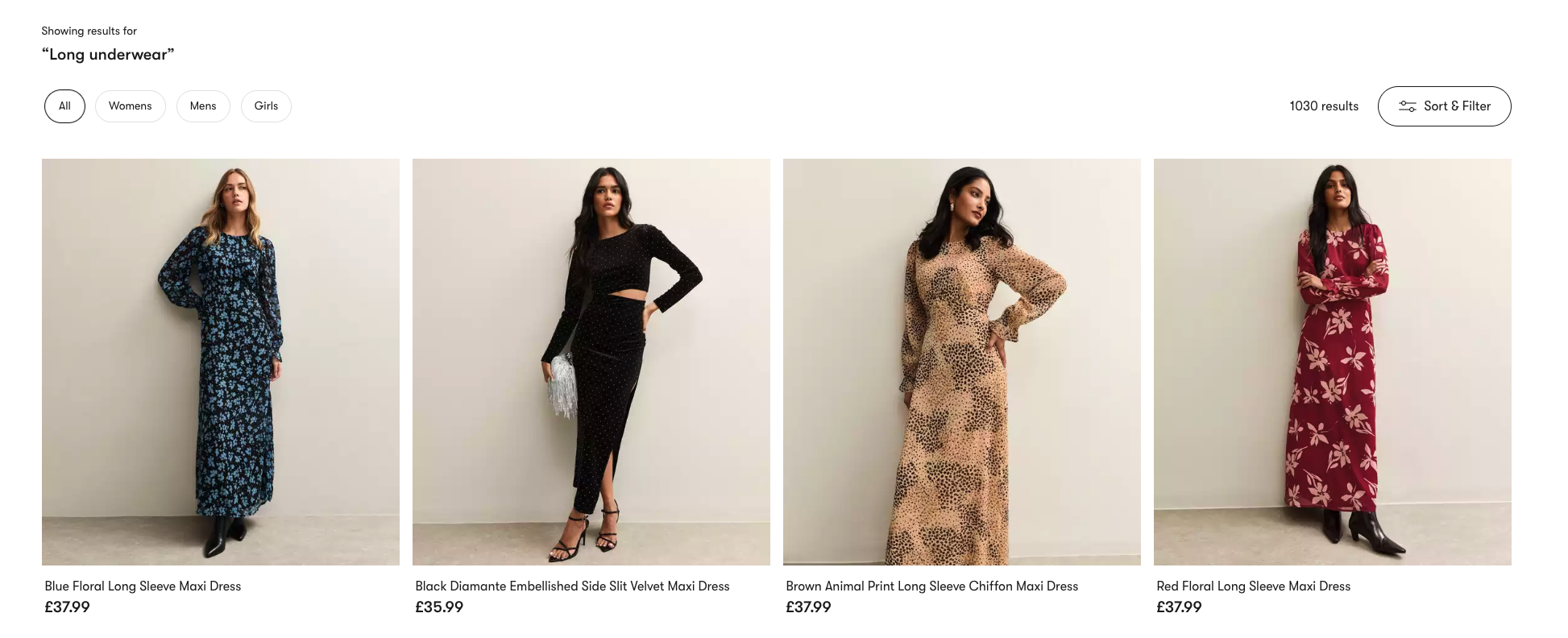

They also lack the ability to understand semantic meaning — i.e., what words truly mean in the context of the entire query — which can lead to some pretty wonky results (a.k.a. irrelevant products).

Keyword-based search engines can miss the mark for a query such as “long underwear,” which refers to thermal, long-sleeved tops and bottoms. These irrelevant results can taint the customer experience, if not discovered and corrected by the merchandising team.

This becomes especially problematic when users include attributes or themes in their queries. Research by Baymard Institute found that 38% of ecommerce sites can’t handle attribute-based keywords like “double drawer” or “with scandi base,” and 46% don’t support thematic keyword queries, such as “retro” or “minimalist.”

Inconsistent units can confuse search engines

Baymard Institute also found that 32% of sites fail to handle unit abbreviations, which is a significant issue for the home furnishings industry. There’s no quick tailor for an extra 2 inches on a sofa or stove.

Measurements alone aren’t always intuitive, and manufacturer product data isn’t always consistent with respect to conversion units and formatting (e.g. 84 in → 84-inch → 84” → 213cm). Inconsistent product data passes through data feeds to search engines. Unless the search engine can harmonize this data and understand that 2” means 5.08cm, search results and filters will fall flat.

Manual enrichment doesn’t scale

Let’s not forget that search queries don’t always contain the important attributes that shoppers want to narrow their results by. Many shoppers intend to search and filter, but faceted navigation can suffer from the same shortfalls that search does when attributes are not complete and harmonized to support reliable filtering.

But manually auditing and tagging product data feeds is time-consuming, error-prone, and unscalable. Today, this task is better left to Attribute Enrichment, a solution powered by Generative AI and machine vision. It auto-tags your products with the right specs, features, and thematic keywords so no product gets left behind in search or facets.

Attribute Enrichment also supports Constructor’s attractiveness algorithm (more on this below!). Shared product attributes can be leveraged in personalized rankings across search, browse, landing pages, product recommendations, and even email remarketing.

Serving attractive results to home goods shoppers goes beyond relevance. It involves using a point solution built from the ground up for ecommerce search, not a one-size-fits-all approach.

How the Attractiveness Algorithm Works

At Constructor, we built a proprietary attractiveness algorithm that ranks products based on the probability that a shopper will click or buy. It goes beyond keyword relevance to incorporate:

- Full Verified Clickstream data: The individual and aggregate user clicks and micro-actions applied across sessions (including click paths, searches performed and refined, sorts and filters applied, scroll depth and dwell times, page engagement, and adds/removals from Favorites or cart)

- Purchase data: What people buy after conducting specific searches or viewing browse pages, and how that tracks back to general purchase behavior (brands, categories, product attributes, price points, etc.)

- First-party data: What you know about each shopper based on profile/loyalty data, email and marketing engagement, past behaviors, and purchase history (note: this is distinct from zero-party data)

- User context: Factors like a user’s device type, geolocation, time of day, current local weather, and referring keyword or ad source (when available)

- Product factors: Attributes and specifications such as brand, price, features, materials, size, dimensions, style (static factors) as well as popularity, “newness,” seasonality, user reviews, SKU variants, inventory status, discounts, and promotions (dynamic factors)

Across our customers, we’ve found significant lifts in click-through rates and revenue when attractive results are returned to shoppers.

Every one-point increase in attractiveness score correlates with a 3.8% lift in click-through rate. Attractive results meet both what a shopper wants and what they are most likely to love. (Read the full report here.)

Source: Beyond Relevance: The Data-Backed Case for Attractiveness as the New Standard for Ecommerce Search Performance

In essence, attractiveness boils down to 1:1 personalization. It means serving the right product to the right person at the right time in the right context, leading to delighted shoppers who are inspired to buy.

How Constructor Understands Shopper Intent

The magic happens when the attractiveness algorithm meets the search query. Several underlying technologies help home goods merchandisers and digital product leaders capture shopper intent and translate it into revenue.

Algorithm mechanics: The technologies at play

Cognitive Embeddings Search (CES)

Constructor’s Cognitive Embeddings Search (CES) is our proprietary vector-based recall engine specifically enhanced for ecommerce. In simple terms, it uses deep learning to build a “vector map” of your product catalog and its associations between product keywords and qualifier terms that represent intent, such as features, benefits, uses, themes, and other buying criteria.

With CES working in tandem with the attractiveness algorithm, Constructor ranks products for each query in the context of what the shopper means and what they’ll most likely click.

The vector map is enhanced with artificial intelligence, including natural language processing (NLP) and transformers, to identify intent within every long-tail query.

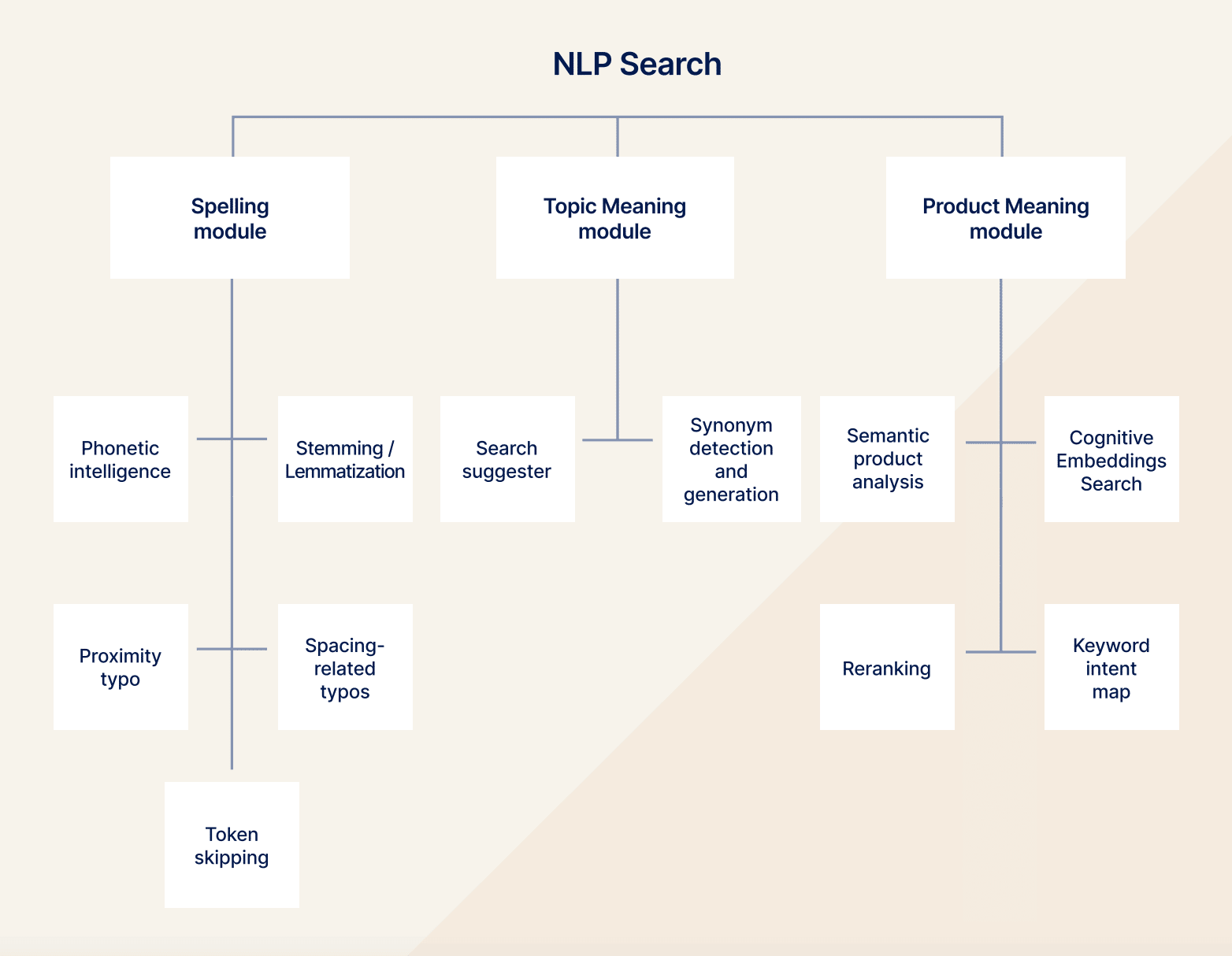

Natural Language Processing (NLP)

Natural language processing (NLP) analyzes the spelling, topical meaning, and product meaning of the keywords in context with each other.

For example, a search for “mattress for light sleepers” will be associated with memory foam or hybrid mattresses, and cross-sells can suggest weighted blankets, body pillows, and silk or cooling pillow cases throughout the journey.

Transformers

Transformers are a type of neural network architecture that can understand and process the natural language meaning of keywords within search queries and map them to their “embeddings,” or their place within the vector map. Effectively, transformers find products that map closest to the semantic (intended meaning) relevance of the user’s query within the vector space.

Together, these technologies enable Constructor to interpret every action and signal that indicates intent — whether it’s the words a shopper types, the page they land on, or the filters they apply.

But intent doesn’t begin and end with search queries. It starts long before a visitor reaches your site and continues to evolve as they explore, compare, and return.

Real-world intent signals

Understanding real-world signals is what transforms algorithmic intelligence into personalized experiences.

Visitors may arrive with signals of intent

A high number of home goods shopping journeys begin on Google or marketplaces. In fact, the furniture/home category sees some of the highest rates of transactional search queries on Google: nearly two-thirds of searches signal purchase intent.

While it’s harder than it’s been in the past to identify referring keywords from organic Google Search, you can still suss out referral context from Google Shopping and ads, Yahoo, Bing, DuckDuckGo, and through UTM parameters from email, social, and affiliate traffic and pass them to Constructor within the session.

Intent can evolve throughout the buying journey

Search queries are just one on-site behavior you can track to get inside your shopper’s head. A smart search engine takes note of what sort and filters they apply, what they click and scroll past, how long they dwell on product pages, and what they add and remove from the cart.

Constructor sniffs out these signals as they happen and incorporates them into the attractiveness algorithm to apply to new searches, search refinements, browse journeys, and cross-sell pods.

Recognize returning visitors

Home goods buyers do their homework and visit an average of 3 websites and 3 physical stores before committing to purchase.

Recognizing returning visitors and remembering their past session behavior helps personalize every new interaction, boosting products that share attributes with past search refinements and products they’ve shown affinities for, while burying those they've ignored.

How Home Goods Intent Differs From Other Categories

While there are always nuances, in general, we can summarize home goods search intent factors versus other categories as follows:

| Factor | Home Goods | Fashion & Apparel | Mass Retail |

| Search specificity | High (often long-tail) | Low (style-based) | Moderate |

| Emotional decision-making | Low (practicality rules) | High (aspirational) | Low |

| Mobile share | High | Very high | Mixed |

| Visual dependency | High (style) | High (style) | Low |

| Attribute clarity | Very high ("[dimensions]," "[material]," "[style]," etc) | Ambiguous ("boho") |

Concrete |

| Repurchase likelihood | Infrequent | Moderate | High |

| Brand loyalty | Low | Moderate | Low |

| Problem-solving intent | Very high | Weak | Varies |

Putting it together

- Home goods are often high consideration purchases. Shoppers take their time across multiple website visits and make logical vs. emotional buying decisions

- Although only 14% of home goods shoppers use site search, those that do exhibit high purchase intent and drive 42% of site revenue

- Home goods site searches tend to be longer and include product attributes like style, size, theme, material, and product specifications

- It’s important that ecommerce merchandisers and digital product managers in the home goods sector prioritize attractiveness over keyword relevance to maximize clicks and conversions

.png?width=1400&height=700&name=takeaways-home-goods-search-intent-factors@2x%20(1).png)

Surface Attractive Products, to Then Hit KPIs

To serve attractive results, ecommerce merchandisers and digital product managers need the right search solution. Intelligent search continuously learns from customer interactions and factors on-site behaviors, purchase history, referral context, and product factors into an attractiveness algorithm.

To sum it up, when you optimize search for attractiveness, you:

- Increase shopper engagement by showing them products that are both visually appealing and practical

- Optimize results to prevent too few or too many matches (a common problem with keyword-based search applications)

- Dramatically increase click-through rates, conversion, and revenue

- Reduce the likelihood of shoppers toggling between product list pages

- Help shoppers make faster purchase decisions with less friction

See how home goods merchants who adopt this capability with Constructor can expect to see 86% more clicks on attractive results than simple relevance matching, resulting in higher revenue and overall conversions.

.png?width=1400&height=700&name=searchers-vs-non-searchers-home-goods@2x%20(1).png)

.png?width=1400&height=700&name=add-to-carts-searchers-vs-nonsearchers-home-goods@2x%20(1).png)

.png?width=1400&height=700&name=conversion-rates-home-goods@2x%20(1).png)