Black Friday 2025 was the largest discovery day ever on Constructor’s platform, with 2.27 billion total discovery requests across search, autosuggest, browse, and recommendations.

But beyond the headline number, this year’s data revealed deeper structural changes in how shoppers seem to be navigating Black Friday.

Below is a deeper dive into the most interesting trends we noticed across geographies, traffic sources, query types, and more.

Black Friday Peaks Differently Across Regions

When we analyzed sustained platform-wide traffic, two distinct patterns emerged: a clear US peak with a steady ramp, and a longer, flatter EU “season.”

United States

US traffic rose in clear, steady stages before reaching a concentrated high point on Black Friday. The shape of the curve was defined by a gradual build-up until the holiday, where the peak more than doubled the seasonal average.

Here’s how the exact progression looked in a representative sample:

- Late September to early October (4.6–4.9K RPS):

Early-season traffic levels, representing normal fall shopping activity.

- November baseline (~5–6K RPS):

The typical daily load heading into the holiday period, before major promotions start.

- Week before Black Friday (~6K RPS):

A modest uplift indicating early deal browsing and increased catalog exploration.

- Black Friday peak (11.6K RPS):

The moment of highest activity, when shopper requests more than doubled compared to standard November levels.

In summary, the 2025 data showed that Black Friday itself remained the major inflection point, producing a substantial jump in traffic that far exceeded the steady increases leading up to it.

Europe: Black Friday as a Multi-Week Season

In contrast, EU traffic rose gradually through late October and November before reaching a smaller, more distributed peak on Black Friday. Instead of a single concentrated surge, the curve stretched across several weeks.

Looking at a representative sample:

- Late October (1.8–2K RPS):

Baseline fall activity, representing normal pre-holiday browsing levels. - Second half of November (3–3.5K RPS):

A sustained increase as promotions rolled out earlier, creating a broad mid-season plateau rather than a sharp climb. - Black Friday peak (~4K RPS):

The highest point in the period, but only modestly above mid-November traffic and roughly double the late-October baseline.

The relative lift underscores the shape of this curve: only 20–25 percent above the late-November average, even though activity nearly doubled compared to late October.

In summary, the 2025 data showed that Europe experienced Black Friday as a multi-week event, with traffic distributed across an extended promotional window rather than concentrated in a single day.

Where Shoppers Started Their Journeys

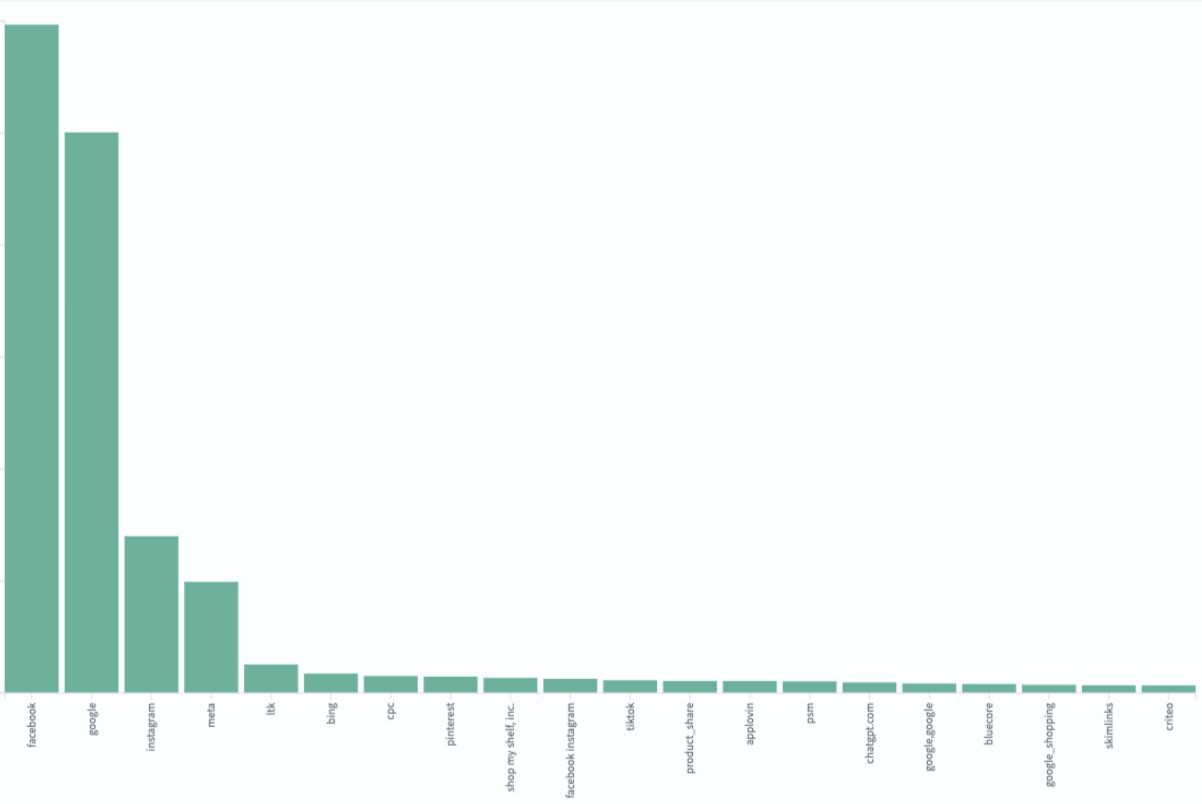

In 2025, the overwhelming share of traffic landing on product detail pages came from the same long-standing sources as previous years. Facebook, Google, and Instagram were the dominant entry points by a wide margin, far outpacing every other referral channel.

Inside that hierarchy, one result stood out simply because it didn’t match expectations: ChatGPT ranked 15th globally as a PDP traffic source. Given the attention around AI-assisted shopping, many assumed it would break into the top group. The volume was meaningful but nowhere close to the levels driven by the established platforms that have shaped upstream discovery for a decade.

We suspect this gap exists because many shoppers may be using ChatGPT as an initial research tool without clicking through its suggested links, and then navigating directly to the retailer once they know what they want.

Promo Searching Behaviors Intensified and Became More Nuanced

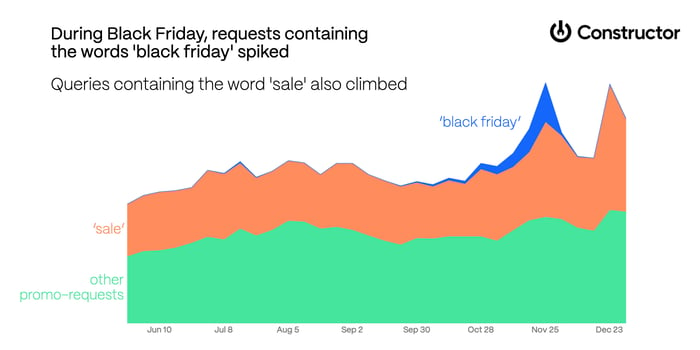

In previous years, we observed promo-related searches (“sale,” “promo,” “offers,” “deal,” and similar terms) spike during Black Friday and Christmas. The 2025 Black Friday dataset showed the same underlying pattern, but with three notable details:

Black Friday concentrated promo intent

During the event, “black friday” became the top promo-related term, with “sale” close behind. The shift was sharp and dominated the broader promo vocabulary that typically builds through the fall.

Promo language varied significantly by category

Our analysis also revealed that shoppers searched for deals differently depending on what they were shopping for:

- Apparel: relied heavily on broad promo terms like “sale” and “clearance”

- Home Improvement: used broad language as well, but favored terms like “outlet” and “offer”

- Toys & Games: frequently used deal-first queries without naming a product, reflecting open-ended discount browsing

- Automotive: combined product and promo terms together (e.g., “brake sale”)

A note on personalization

The data showed that conversion-to-click on promo requests was three times higher than on non-sale requests. This mattered most when shoppers used natural-language promo terms that didn’t appear verbatim in product data. Retailers whose systems could interpret these requests were better positioned to capture the lift, because more of those high-intent queries surfaced relevant results.

Taken together, the 2025 data showed a surge in promo interest that was both highly concentrated and highly variable, with category-specific language shaping how deal-seeking shoppers reached products.

What Retailers Should Take Into 2026

- Build region-specific calendars

Whereas the US experienced a single-day spike; Europe experienced a steady, multi-week season. Planning windows, pricing updates, and discovery logic should follow the pattern of each market rather than a single global holiday model. - Support mid-stream shoppers who land directly on PDPs

Much of the 2025 traffic came from social and search referrals, meaning many shoppers entered retail sites through product pages rather than starting on-site. If the first product isn’t the right fit, ensure you’ve built solid recovery paths — adjacent-product suggestions, or onsite agents that can address questions and concerns — to keep those sessions engaged. - Ensure your discovery engine can interpret natural-language promo terms

The 2025 dataset showed a wide range of promo phrasing across categories, and promo-intent searches delivered 3× higher conversion-to-click than non-promo requests. Given how often shoppers used broad or incomplete language, retailers should ensure their discovery engines can surface attractive, relevant results even when intent is vague or only loosely expressed.