.webp?width=700&height=350&name=ecommerce-product-discovery@2x%20(1).webp)

Search as part of a commerce platform is no longer enough (and Forrester echoes this). Customer journeys now span Google, social media, marketplaces, and your own site, making on-site discovery your critical “second chance” to convert.

This article is a vendor-agnostic look at strategy, real examples, and practical next steps for mid- to enterprise retailers ready to treat discovery as a revenue lever.

What Is Ecommerce Product Discovery (Today)?

Ecommerce product discovery is the combined experience that helps a shopper move from an intent (however clear or vague) to the right item.

Essentially, product discovery goes far beyond a search box, encompassing every interaction that influences what products a shopper sees and how they evaluate them. This includes search, browse, recommendations, landing pages, agents, and other point solutions. It also includes homepage layouts, primary navigation, product listing pages (PLPs), filters, sort orders, recommendation carousels, quizzes, and PDP content.

Every site element influences whether a shopper finds what they came for — or leaves frustrated.

In practice, this looks like:

- A shopper types “black work shoes size 10” into your search bar. They have a specific query, and they expect accurate search results that match their exact needs

- Another shopper lands on your site from a TikTok link about “home office upgrades.” They have no specific product in mind. They want to browse, explore, and be inspired

- A third shopper comes to your site and searches “what should I bring on a first-time camping trip with two kids under 10?” They’ve arrived with intent, but need product ideas

All three shoppers are experiencing product discovery. It's just that a couple are searching (clear intent), and another is browsing (vague intent). No matter the journey, your site needs to serve them effectively.

This product discovery process applies to all retail models — fashion, grocery, general merchandise, B2B — but it looks different depending on your catalog size and buying cycles. A 500-SKU specialty retailer has different discovery needs than a 2-million-SKU marketplace. The principles, however, remain the same: help a person find the right product at the right time, in as few steps as possible.

How Social, Marketplaces, and GenAI Are Reshaping Discovery

Discovery no longer starts on your site. It starts wherever customers interact with your brand.

Social as a discovery channel

Platforms like TikTok, Instagram, and YouTube are now primary discovery channels, as shoppers find products through influencer content, shoppable posts, and algorithm-driven feeds — only to then land on your PDPs, not your homepage.

This changes what on-site discovery must accomplish:

- Continue the story from the social content that brought them

- Surface related products for cross-sell and upsell

- Provide social proof (UGC, reviews) that validates what they saw off-site

- Offer visual search capabilities and, in general, a discovery experience that feels like scrolling a feed, not searching a database

Marketplace training

Amazon, Walmart, and regional marketplaces cracked the code in helping shoppers find inspiration when deciding what to buy, by adding sophisticated discovery features such as instant product suggestions, rich filters, and “inspired by your browsing” personalized experiences.

Since offering these features, shoppers have come to expect them wherever they shop online. That includes your site.

If your site search and navigation feel primitive by comparison, you lose credibility — and the sale.

GenAI and Conversational Commerce

GenAI assistants — on devices, in apps, and as chatbots — use natural language processing to understand complex queries and deliver personalized recommendations, almost immediately.

Retailers must adapt by:

- Ensuring product catalog data is structured for AI consumption

- Building or integrating conversational guides that help refine needs

- Connecting off-site signals (ad creatives, influencer content) with on-site discovery

How Product Discovery Shows Up Across Your Ecommerce Experience

Most shoppers don’t think about “product discovery” in and of itself, but they do notice how well they can find products on your site, apps, and off-site experiences. If the process feels effortless, customers show that with their wallets. If it doesn't, customers leave.

The following are common areas on your site where the right product discovery solution can make a positive impact:

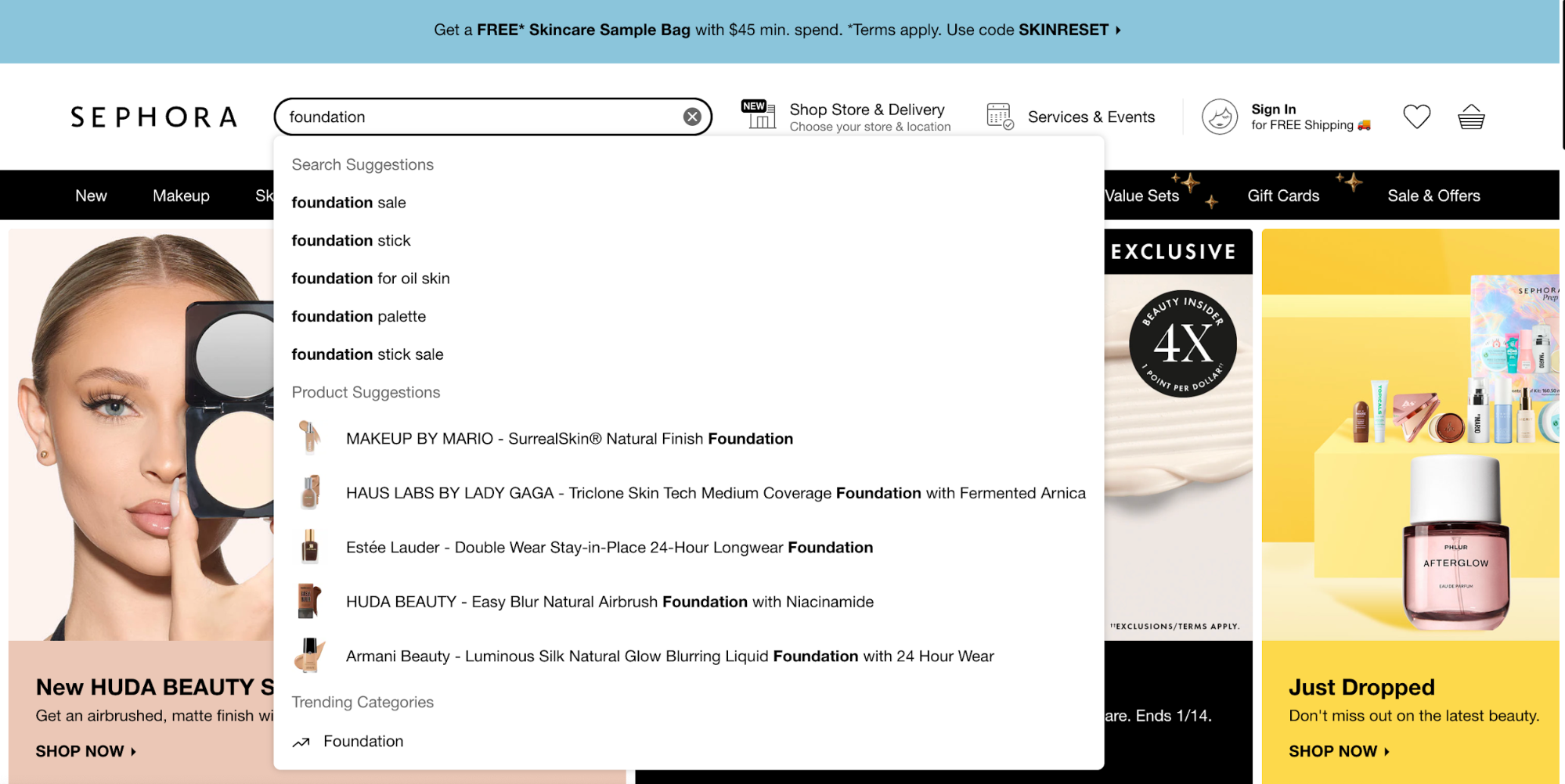

On-site search

Your search function is often the first place shoppers with intent go. When someone uses the search bar, they’re signaling exactly what they want.

The quality of that search experience depends on several factors:

- Query handling. Does your ecommerce search understand natural language and complex search queries like “find me a red dress for a summer wedding that's under $150”?

- Smart autocomplete and autosuggest. Does predictive search help shoppers refine their query before they hit enter?

- Typo tolerance. Can your search handle misspellings without returning zero results?

- No-results pages. When queries fail, do you offer helpful alternatives or just a dead end?

Poor site search creates what experts call “search zero” moments — i.e., where shoppers bounce immediately because they can’t find relevant results.

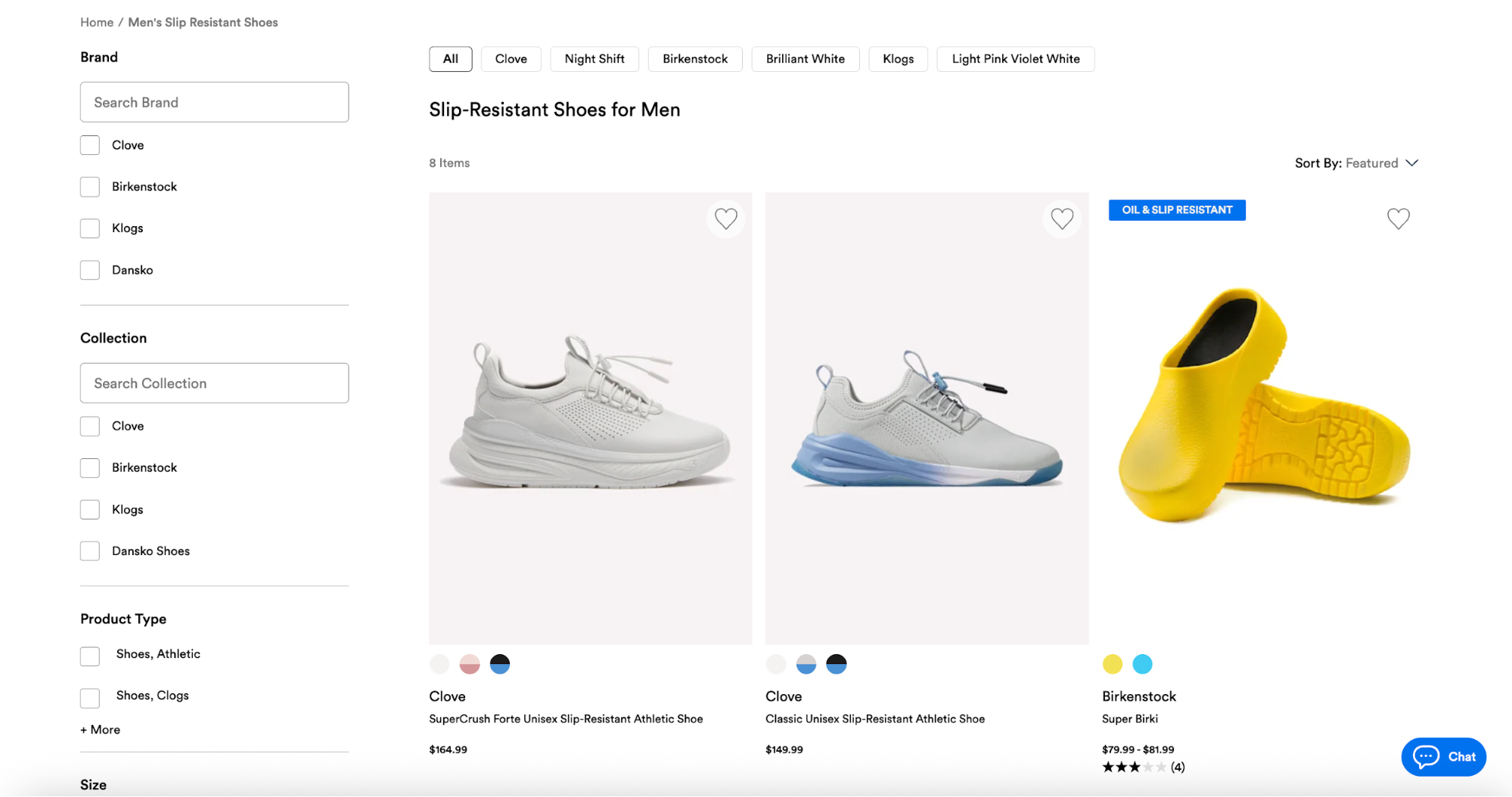

Navigation and category pages

Even in a world where some searchers migrate to answer engines like ChatGPT, shoppers will still go to sites with compelling Browse experiences. This is especially true for those who don’t arrive with a specific search intent.

Your primary navigation — mega menus, category hierarchies, visual merchandising, and breadcrumbs — guides these exploratory shoppers toward products they didn’t know they wanted.

Key elements that support discovery through navigation are:

- Clear category structures that match how customers think, not how your inventory system is organized

- Visual merchandising on category page layouts that highlight key products (such as badges, which are proven to reduce decision fatigue)

The “Oil & Slip Resistant” badge helps shoppers easily identify the right product for their needs amongst a list of product results. - Breadcrumbs that help shoppers understand where they are and navigate back easily

- Seasonal or lifestyle-based navigation, which can change overnight and is always fluid (e.g., categories from “Back to School” or “Work From Home Essentials” to those that cater to people suddenly looking for shovels after an unexpected snow storm)

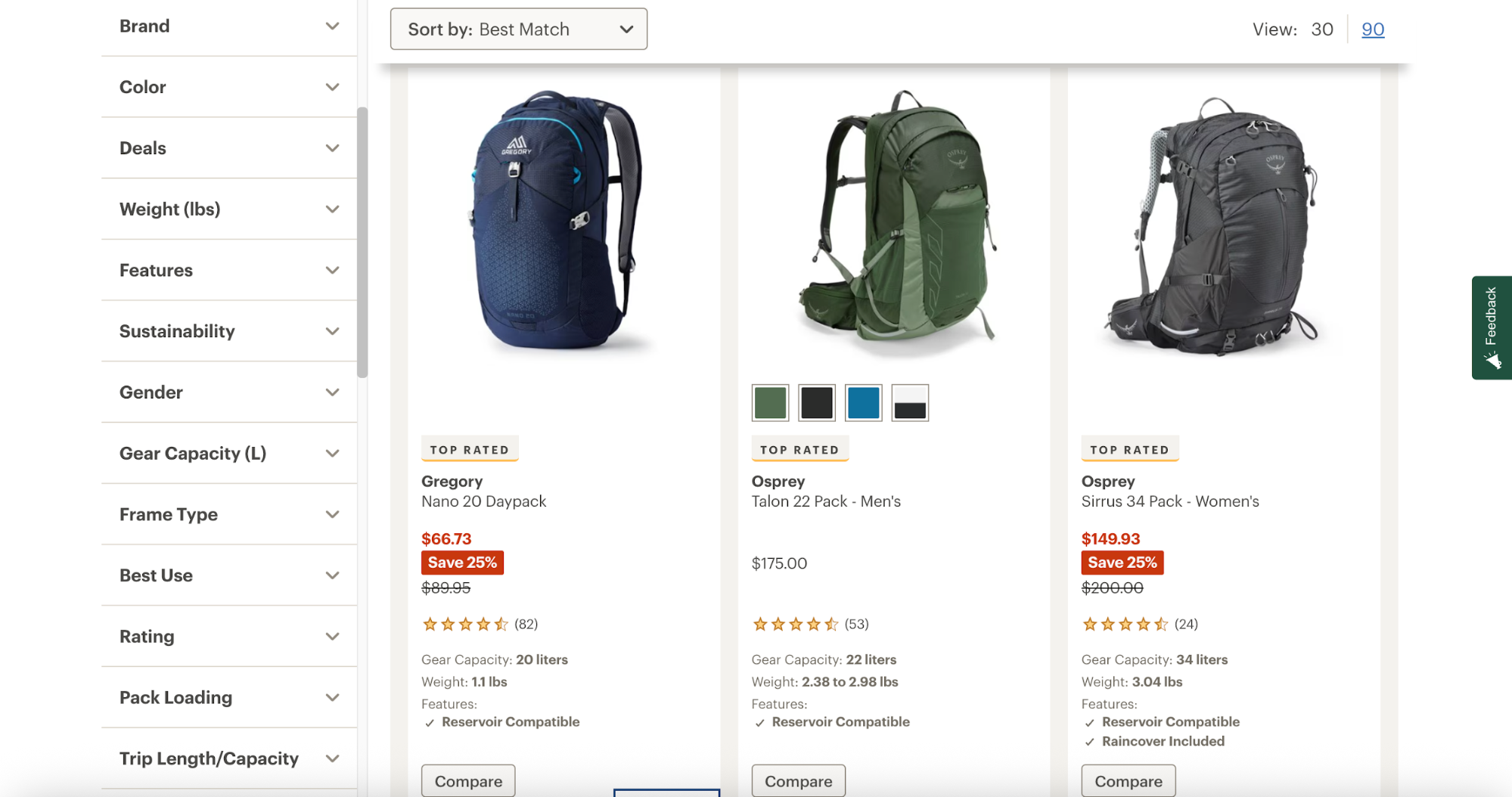

Facets and filters

Facets in search results or category pages help shoppers narrow results so they can find the best-fit products, quicker. But legacy filter implementations often frustrate more than they help.

Modern discovery requires facets that match how customers shop:

- Concern-based facets for beauty (“sensitive skin,” “acne-prone”)

- Attribute facets for apparel (“petite,” “sustainable materials”)

- Lifestyle facets for home goods (“small space living,” “renter-friendly”)

- Contextual facets beyond “price low to high” or “best sellers”

Having rigid faceted search and faceted navigation forces shoppers into predefined paths. Keep them (and subsequent filters) flexible and intent-aware — even updating dynamically for an improved product discovery experience.

Recommendations and content modules

Similar to other product discovery solutions, the right recommendations engine gets the right products in front of the right people at the right time. It's not simply a question of: where do I place the recommendation module? It's: which recommendations module do I place where in order to receive the business outcomes I want?

Locations vary — with modules appearing on homepages and product listing pages (PLPs) to product detail pages (PDPs), carts, and more — in addition to the proper strategy. Common recommendation strategies that drive discovery are:

- “Bestsellers” and “Trending Now” for social proof

- “People Also Bought” for cross-sell opportunities

- “Complete the Look” or “Frequently Bought Together” for bundles

- “Recently Viewed” for return visitors

To learn more about the fundamental building blocks you need to ensure your recommendations are driving business outcomes — not just more eyeballs — check out our product manager-written guide to recommendations.

.png?width=2800&height=1400&name=recommendation-strategy-cheat-sheet@2x%20(1).png)

Product Detail Pages (PDPs) as discovery touchpoints

Product detail pages (PDPs) are both discovery and conversion points. Strong discovery elements keep shoppers exploring once they land on a PDP, such as:

- “More from this brand” carousels

- Comparison charts with similar products

- Educational content that helps shoppers understand product categories

- Agentic AI helpers like the AI Product Insights Agent (PIA) that help shoppers answer last-minute questions and increase confidence in their purchasing decision

The end goal is to help each shopper find the right product, even if the first one they clicked isn’t it.

From Legacy Search to Modern Product Discovery

Effective search today is almost unrecognizable from where it began.

Legacy ecommerce search and discovery vendors — in addition to solutions that live inside ecommerce platforms — rely on exact keyword matching with rigid synonym lists, rule-based merchandising that requires manual intervention for every change, and default “most popular” sorting that ignores individual shopper context, among other characteristics.

The legacy approach favors search relevance — i.e., matching products to query terms (more on this below!) — without prioritizing whether those matches actually convert. This leads to predictable problems, such as:

- High “no results” rates for misspelled or ambiguous queries

- Irrelevant ranking that surfaces out-of-stock or low-margin items at the top

- Shoppers bouncing back to Google or Amazon when your site fails them

- Merchandisers spending hours manually adjusting rules instead of focusing on strategy

On the other hand, modern product discovery is intent-aware. It uses shopper behavior (in the form of full, verified clickstream data) and context to infer what a shopper is trying to achieve and what they actually want.

The shift includes:

- Advanced reasoning: Models use data and learnings to interpret context, intent, and product relationships, breaking their decisions into multiple steps to make human-like judgments about what products to show in real time to each individual shopper (i.e., understanding that “summer outfit for beach wedding” means lightweight, dressy, and appropriate for warm weather)

- Reinforcement learning: Machine learning models observe which products people tend to choose, ignore, or return for each type of intent, and then use that information to strengthen the system’s intelligence over time

- Real-time personalization: Adapting product suggestions based on current session behavior, not just historical data

What this looks like in practice

Consider a beauty shopper who types “hydration” into your search bar.

In a legacy system, she gets every product with “hydrating” in its description. There’d be hundreds of items, in no particular order.

In an intent-aware system that works on a feedback loop, the results factor in her profile (oily skin, based on past purchases), her browsing behavior (lingered on serums, skipped creams), and contextual signals (summer, mobile visit). She sees a curated set of lightweight hydrating serums, with product suggestions for complementary items.

The difference in conversion rates between these two experiences can be 2-3x.

Relevance vs. Attractiveness: Rethinking “Good” Results

Traditional discovery optimizes for relevance, or how well results match a query’s terms and attributes. Relevance answers the question: “Does this product match what the shopper typed?”

But relevance alone doesn’t drive ecommerce sales. Attractiveness does.

Modern discovery goes beyond relevance to attractiveness, which is the probability that a shopper will click, add to cart, and keep the item. Attractiveness answers the question: “Is this product likely to convert?”

A product can be highly relevant (matching every keyword) but unattractive (poor images, low reviews, high return rate). Optimizing only for relevance surfaces technically correct but low-performing products.

.jpg?width=1400&height=700&name=laptop-relevance%20(1).jpg)

Attractiveness signalsModern ranking considers multiple data sources beyond text matching:

|

Discover more about the data-backed case for attractiveness as the new standard for ecommerce search performance.

Designing a Modern Ecommerce Product Discovery Strategy

Strategy without execution is just theory. Here’s a practical roadmap for Directors and VPs to move from concept to execution over the next 6-18 months.

Establish cross-functional ownership

Discovery spans ecommerce, product, merchandising, data, and engineering. No single team owns it, which means no one owns it unless you’re intentional.

Align stakeholders on shared KPIs, such as:

- Search-led revenue (revenue from sessions that included a search)

- Discovery-led average order value (AOV)

- Bounce rate from key category pages

- Recommendation click-through rate and revenue attribution

Start with a discovery audit

Before building a roadmap, understand your current state:

- Analyze your top 100 site searches: What queries drive volume? What’s the conversion rate from each?

- Review “no results” queries: What are shoppers looking for that you’re not surfacing?

- Measure exit rates from key category pages: Where are shoppers giving up?

- Assess recommendation engagement: Are carousels getting clicks? Converting?

This audit reveals where you’re losing the most revenue and where quick wins exist. Even better, have an expert do it for you instead.

Build a prioritized backlog

Treat discovery as a product, not a project. Build a backlog of fixes and experiments across four areas*:

|

Area |

Example Improvements |

|

Search |

Synonym expansion, typo handling, semantic understanding |

|

Navigation/PLPs |

Concern-based filters, lifestyle categories, visual merchandising |

|

Recommendations |

Personalized algorithms, placement testing, bundle logic |

|

PDPs |

Comparison charts, “more like this,” size/fit guidance |

* Prioritize by impact (revenue potential) and effort (technical complexity)

Adopt Test-and-Learn

Discovery improvements should be validated, not assumed:

- A/B test ranking strategies before full rollout

- Test new filters with a subset of traffic

- Experiment with recommendation placements across devices

- Measure downstream metrics (returns, customer satisfaction), not just clicks

Define governance guardrails

Automated discovery shouldn’t conflict with business goals, yet ensure the ability for manual input around core capabilities:

- Protect brand partnerships and minimum visibility commitments

- Ensure pricing parity and promotional compliance

- Set margin floors so algorithms don’t over-surface low-margin items

- Build manual override capabilities for merchandising features during key campaigns

A well-executed strategy happens at the intersection of algorithmic optimization and human control.

Practical Examples of Modern Product Discovery in ActionWhile theory is helpful, examples are better. Here are vertical-specific use cases that make the strategy concrete. Apparel: Intent-aware Search + Complete the LookA mid-market fashion retailer struggles with high search bounce rates and low cross-sell from recommendations. Starting problem: Search returns results sorted by popularity, ignoring size availability and customer preferences. Recommendations are generic “bestsellers” that didn’t relate to the viewed items. Discovery changes:

Outcome: Double-digit uplifts in search-led revenue and items per order, along with a measurable reduction in size-related returns. Beauty: Concern-based filters and quizzesA beauty retailer found that shoppers abandoned category pages without engaging. They were overwhelmed by thousands of SKUs across the entire catalog. Starting problem: Filters were limited to brand, price, and product type. Shoppers couldn’t filter by skin type or concern. Discovery changes:

Outcome: Significant increase in filter usage, higher add-to-cart rates, and improved customer experience scores in post-purchase surveys. Home & DIY: Lifestyle navigation + comparison chartsA home goods retailer with complex catalogs struggles with a deep category hierarchy: shoppers average 7 clicks to reach a product. Starting problem: Navigation is organized by product type (“Desks,” “Chairs,” “Storage”), not by shopper need. Discovery changes:

Outcome: Reduced clicks-to-product, increased engagement with comparison content, and higher confidence in purchase decision (measured via reduced returns). Grocery: Time-sensitive discovery flowsA quick-commerce grocery app notices that queries like “dinner in 20 minutes” return random items rather than meal solutions. Starting problem: Search matched keywords literally, not intent. Discovery changes:

Outcome: Higher basket size from intent-driven queries, improved customer satisfaction with meal planning use cases. |

Turning Discovery Into a Competitive Advantage

Ecommerce product discovery is now a board-level revenue lever, not just a search configuration issue.

Winning retailers treat discovery as an integrated, intent-aware system spanning search, browse, recommendations, and all other onsite and offsite touchpoints — and continuously optimize it. They measure discovery performance with the same rigor they apply to marketing spend and supply chain efficiency.

The core mindset shift: move from “show relevant products” to “help each shopper confidently choose the right product in as few steps as possible.”

Discovery done well creates a competitive advantage. It improves conversion rates, boosts AOV, reduces returns, and builds customer loyalty that compounds over time.

Your immediate next steps:

- Run a discovery audit this quarter. Analyze your top searches, no-results queries, and category page exit rates

- Align stakeholders on 2-3 shared KPIs that span search, merchandising, and product

- Prioritize 2-3 high-impact improvements to test in the next 90 days

- Establish a regular cadence for reviewing discovery performance and iterating

The retailers who invest in discovery now will capture demand that their competitors miss out on. Ecommerce product discovery matters. Are you ready to treat it as the strategic priority it deserves?

Frequently Asked Questions

How is ecommerce product discovery different from on-site search?

On-site search is one component of discovery, but discovery encompasses much more. It includes navigation, category pages, filters, sort orders, recommendation modules, quizzes, PDP content, and every other on- and off-site experience needed to match shoppers to best-fit items.

Basically, ecommerce product discovery is the end-to-end process that helps shoppers find the right products at the right time — not just what happens in the search bar.

Do we need a full replatform to improve product discovery?

No. Many high-impact improvements — better catalog data, smarter merchandising rules, UX refinements, A/B tests on ranking — can be implemented on existing ecommerce platforms. Start with what’s achievable now. A replatform may eventually make sense, but don’t let it become an excuse for inaction on improvements you can make today.

How long does it typically take to see impact from discovery improvements?

Quick wins in search and recommendations can show measurable impact within 4-12 weeks. Larger initiatives — like implementing advanced features for semantic search, building robust personalization infrastructure, or overhauling category architecture — may take 6-12 months to fully realize. User research and continuous testing throughout accelerates learning and compounds gains over time.

What data do we actually need to get started with intent-aware discovery?

You don’t need a perfect data warehouse to begin. Start with the essentials: clean product attributes in your product catalog (size, color, category, price); search query logs; clickstream events (views, adds, purchases); basic customer segments; and stock/margin data. Many retailers make significant progress by simply connecting existing data sources more effectively to their discovery systems.

How do we balance algorithmic personalization with merchandising control?

The most effective approach is a hybrid model that uses algorithms to optimize ranking and recommendations within guardrails defined by merchandisers. For example, algorithms might determine the order of 95% of products on a category page, while merchandisers pin specific items, set minimum brand visibility, or suppress items below margin thresholds. This preserves the efficiency of machine learning while maintaining strategic control over business goals.

What about data quality and privacy?

Intent-aware discovery requires clean product catalog data, consistent tracking via your CDP or analytics platform, and compliance with GDPR and CCPA. You need customer profiles built from first-party data, not third-party cookies that are increasingly restricted. The retailers winning at discovery treat data infrastructure as foundational, not an afterthought.

.png?width=1400&height=350&name=Subscribe-ST-Digest@2x%20(1).png)