How commerce search and product discovery deliver business outcomes and operational excellence

“Composable commerce is the future of digital commerce” has been the mantra of the past two years. In 2022, many brands and retailers invested significantly in overhauling underlying commerce infrastructure — at all costs.

The promise: the agility and flexibility to respond to customer demand and market movements faster than the competition. The improved shopping experience then drives more revenue — indirectly — as a result.

While we advocate for MACH architecture and the competitive advantage that the resulting agility and flexibility bring, the opportunity cost of not having this advantage, sadly, does not show up on a balance sheet.

Gartner’s Hype Cycle for Digital Commerce placed composable commerce in the early stages of the “Peak of Inflated Expectations” in summer of 2022. This scary-sounding phase occurs when “an innovation becomes the subject of over-enthusiasm and unrealistic projections, as well publicized activity by technology leaders results in some successes but more failures.”

Forrester’s recent report Predictions 2023: Commerce calls out a similar theme: “Commerce operations will take center stage as digital businesses dial back their promises.” The Forrester analysts see a slowdown of the “flurry of pandemic-induced panic” and predict that in 2023 commerce leaders will “keep revenue front and center by funneling investment into the moments that matter” and “focus on commerce costs and the bottom line.”(2)

In other words, effectiveness and efficiency will become the primary drivers of technology choices.

What does composable commerce success look like in 2023?

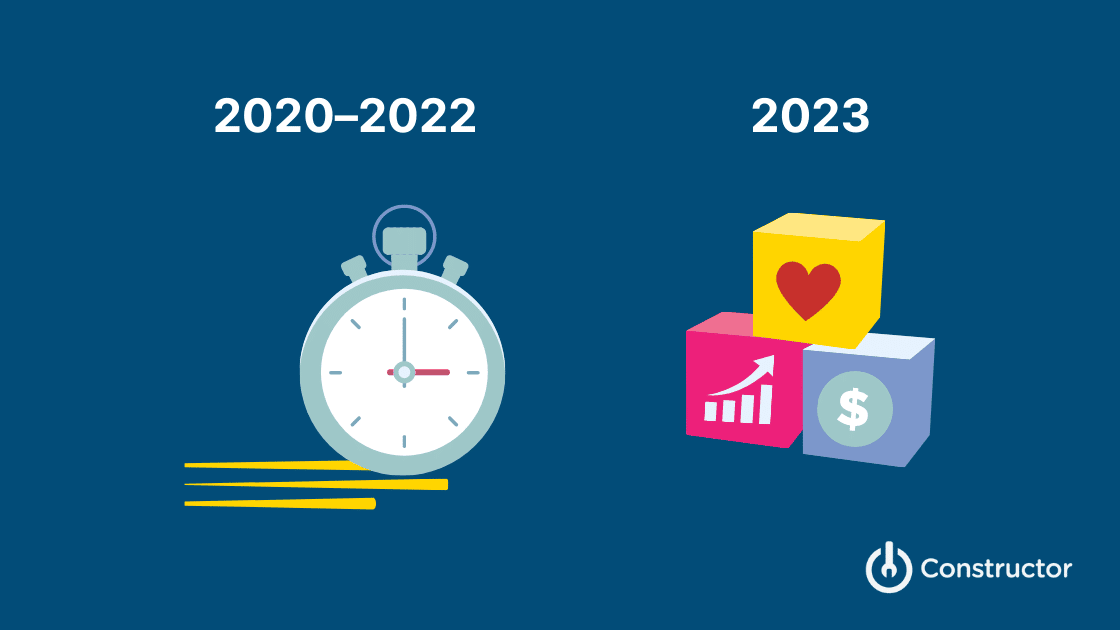

In 2022, success was often measured against metrics speaking to speed and agility. While those are important and valuable for a company to stay ahead of customer expectations and the competition, they do not tie directly to top-line revenue.

The inflated expectations we have seen over the past two years typically come from the assumption that transforming the core transactional components of composable commerce architecture is fast and easy. In reality, changing integral parts of any enterprise architecture always comes with complexity, intentional change, and risk management. It requires a deliberate balance of phasing out the old and making room for the new.

The replatforms that were necessary because of broken legacy technology are coming to a natural end. Ecommerce growth is going back to pre-pandemic times and as if the past years had not been hard enough, we are now faced with added economic uncertainty.

The result: indirect returns from agility and speed are losing some of their attractiveness to predictable direct returns and stability.

According to Forrester, 44% of software decision makers whose organization has or plans to adopt B2C commerce solutions say they are looking to replace their B2C commerce stack. But the analysts also predict that many will over-pivot and, rather than investing into pre-built packaged tools, try to build too much of the stack themselves: “In 2023, a third of digital businesses will abandon or restructure midstream projects that prove too complex to execute or maintain.”

The focus instead will be on function-first, future-fit technology purchases that serve a clear business purpose and drive tangible bottom line outcomes.

Economic uncertainty drives a new approach to tech investments

Savvy enterprises approach their composable commerce stack in 2023 with an investor mindset, starting with experiential customer-facing technologies that can prove an immediate return on investment by lifting both digital commerce experiences and bottom-line metrics.

Upleveling the search and product discovery moments in a shopper’s journey is an ideal first step, because they are comparably fast and easy to implement. More importantly still, they are the easiest to create and prove direct return on investment which companies can verify themselves in A/B tests.

So how come commerce search and product discovery have been an afterthought until fairly recently? Many different factors come into play, but it all boils down to perceived pain. A bad search and discovery experience contributes to higher cart abandonment, higher search abandonment and higher bounce rates — in essence, people leaving. And while those metrics may be daunting, the voices of people who left are silent.

Looking inward into the organization, merchandising teams hustle and work overtime to fix broken search experiences. Constructor’s recent State of Ecommerce Merchandising report shows that ecommerce leaders are often unaware of the strain put on merchandisers. Especially during the busy seasons, these teams are deep in the mines of merchandising and simply have no time to complain. They either get on with it, or leave. In both cases, they too are silent.

In contrast, suboptimal experiences further down in the customer journey — in the order, fulfillment, and customer service stages — typically result in active complaints and get amplified by the voices of customer experience and customer service leaders.

In 2023, rather than following the pain-driven path of technology investment choices, digital commerce leaders will focus on the value-driven path by balancing opportunity and risk — exactly the focus afforded by composable commerce.

And commerce search and product discovery may just be the secret to lift revenue and customer experience at the same time — fast, reliably, and tangibly.